Welcome back to Daily Chartbook: macro market charts, data, and insights pulled from various sources around the Internet by a solo retail investor.

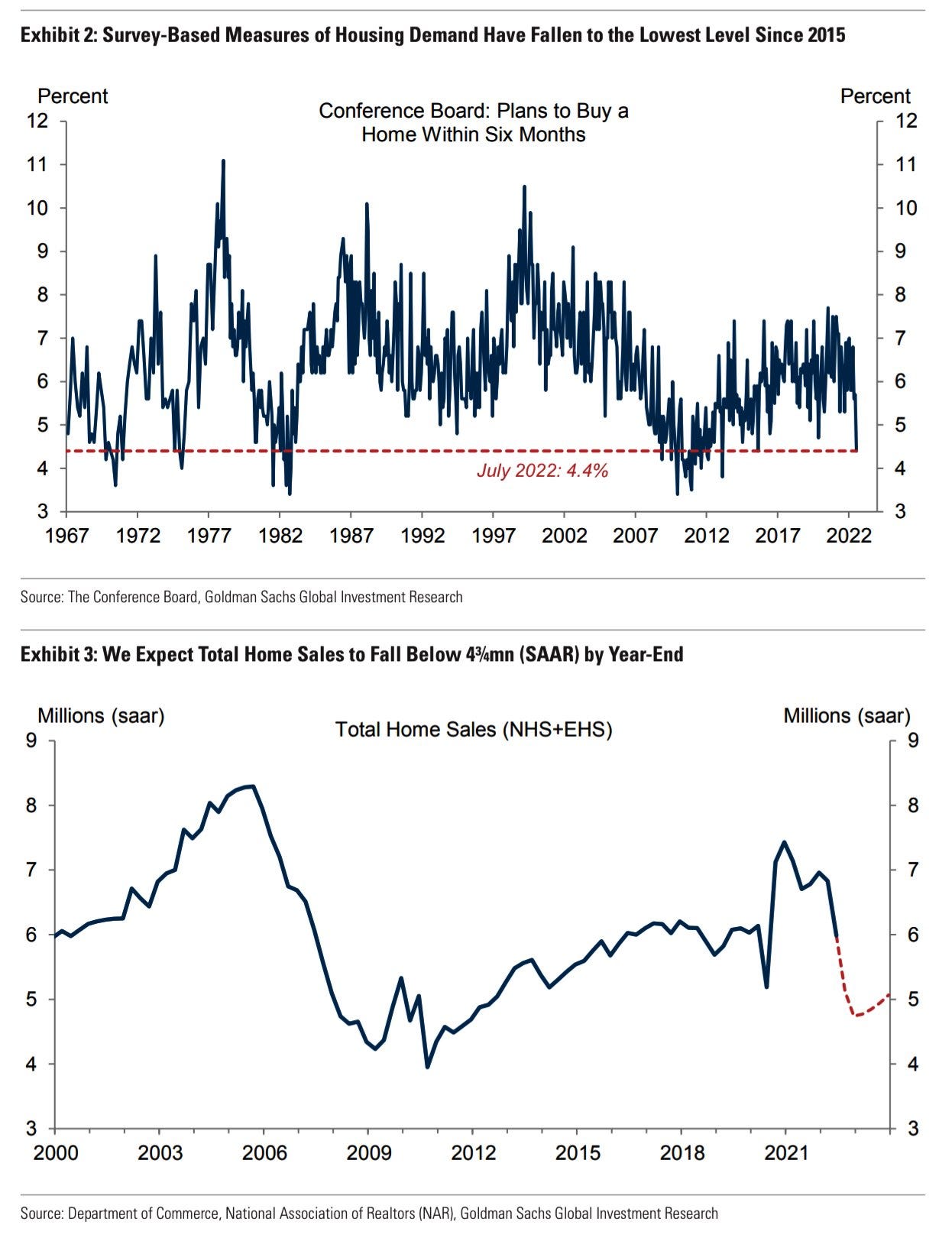

1. Goldman on housing (I). Goldman Sachs expects total home sales to fall significantly by the end of the year.

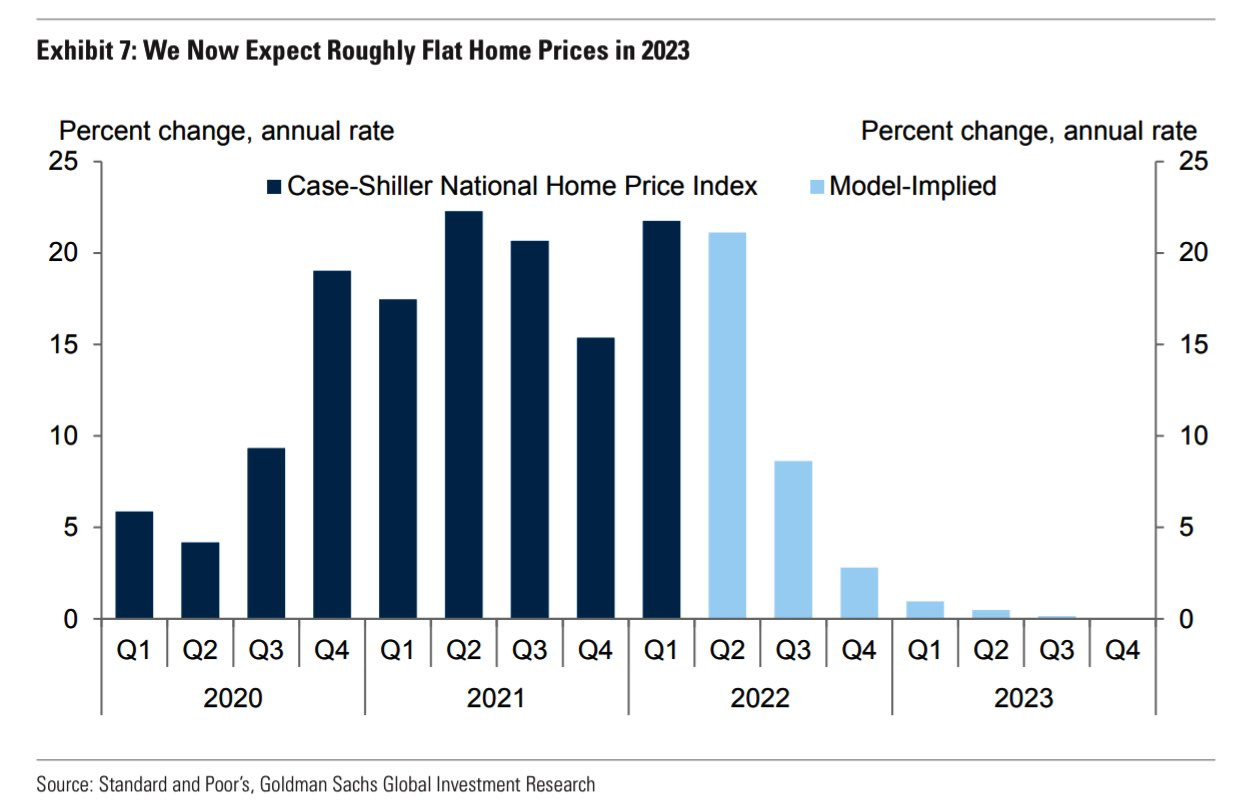

2. Goldman on housing (II). The bank is expecting flat home price growth in 2023.

3. Home price growth slows. CoreLogic's "20-City Index (blue) +18.6% y/y vs. +19.2% est. & +20.5% in prior month; overall U.S. National Home Price Index (orange) +18% vs. +19.9% in prior month".

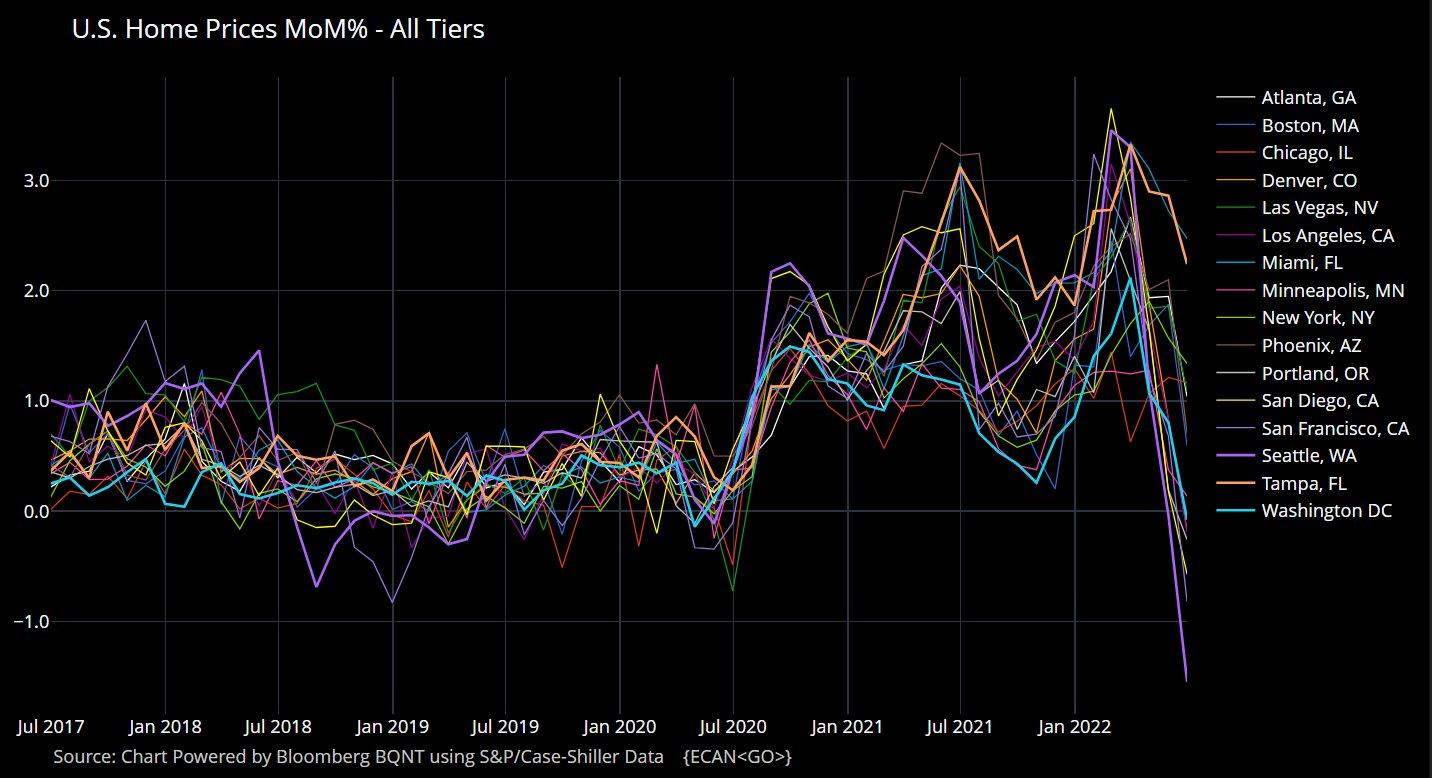

4. Peak home prices. Home prices have peaked in all major markets.

5. Housing expectations freefall. "Expectations of healthier housing market continue to implode from both builders’ and consumers’ perspectives". This chart shows expectations for home value growth (blue) and future sales (orange).

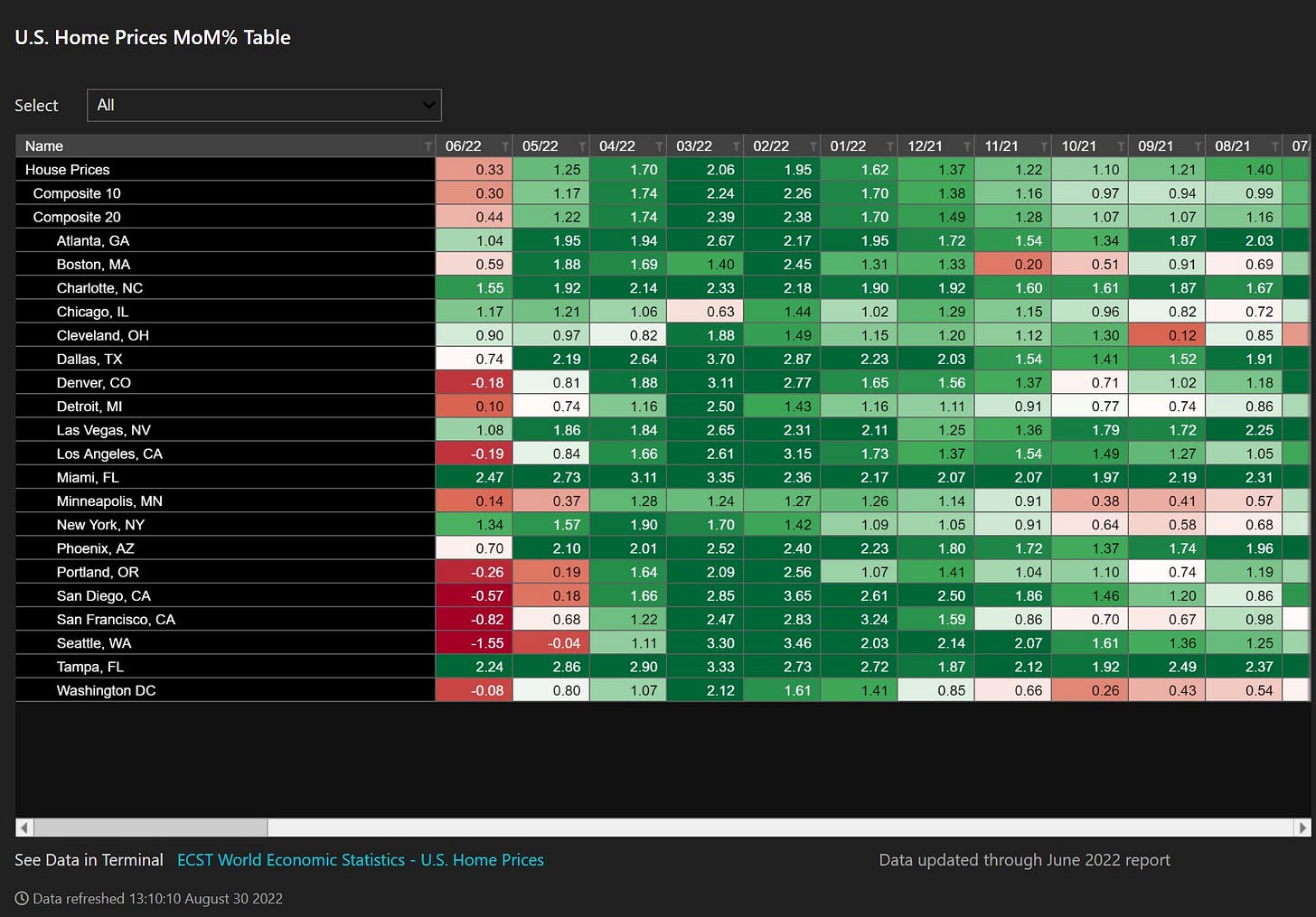

6. Regional prices (I). Home price changes by region (MoM).

7. Regional prices (II). Home price changes by region table (MoM).

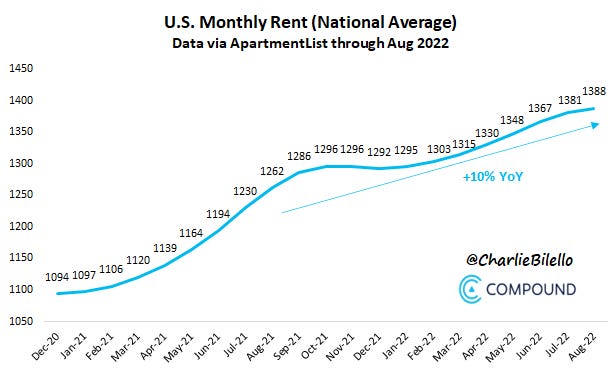

8. Rents up. US rents are up to a new record after increasing 10% YoY.

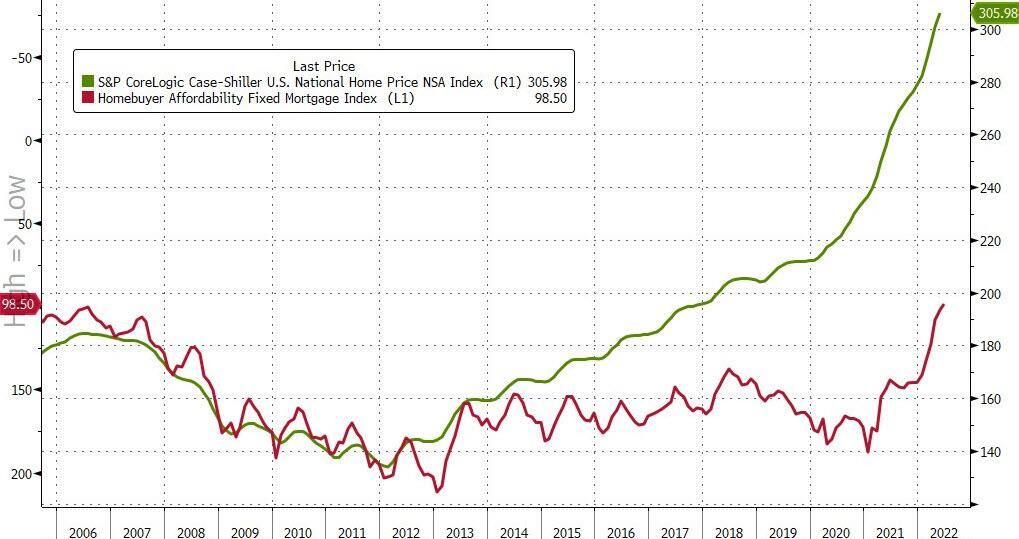

9. Affordability (or lack thereof). Home affordability hit a new record low while "the average home price in the US is now 65% higher than at" the previous trough in 2006.

10. Supply chain easing (I). Demand for trucking has dropped sharply.

11. Supply chain easing (II). "The NY Fed’s global supply chain stress indicator has been moving lower but remains elevated."

12. Supply chain easing (III). Benchmark shipping rates continue coming down off their highs.

13. Q3 GDP. From Goldman Sachs: "We lowered our Q3 GDP forecast by 0.3pp to +1.0% (qoq ar) over the last week, primarily reflecting weaker-than-expected personal spending data."

14. JOLTs (I). There were 11.2 million job openings in July, reflecting an increase of 199,000 (vs. estimates of a 590,000 drop). Quits were little changed at 4.2 million.

15. JOLTs (II). Openings by industry.

16. JOLTs (III). There are nearly 2 job openings for every unemployed person.

17. Consumer confidence. Consumer confidence rose to 103.2 vs. estimates of 98. "48.0% of consumers said jobs were “plentiful,” down from 49.2%. However, 11.4% of consumers said jobs were “hard to get,” down from 12.4%."

18. Consumer confidence (II). The Present Situation Index "rose to 145.4 while expectations climbed to 75.1".

19. Pessimistic business leaders. CEO confidence has fallen below the pandemic trough.

20. Rates not buying it. The rates market is not buying the "higher for longer" narrative from the Fed.

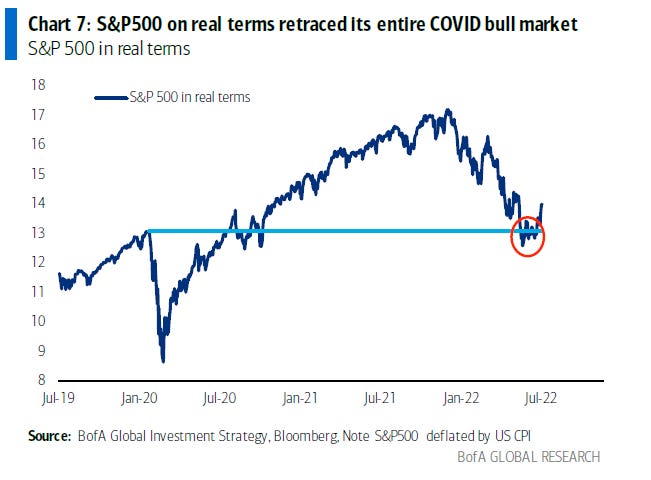

21. All gone. After adjusting for inflation, the S&P has given up nearly all of its post-Covid rally gains.

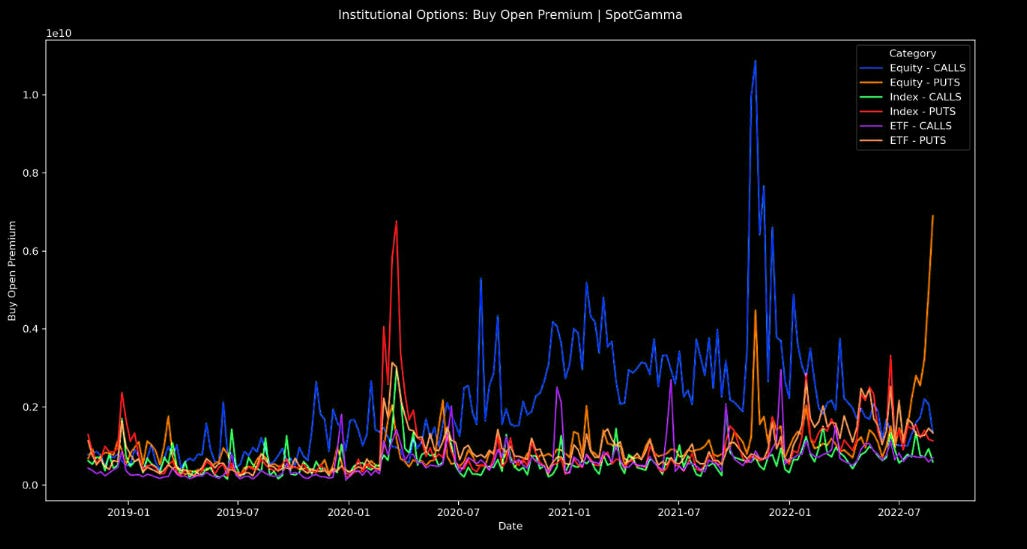

22. Institutional options activity. Investors have switched forcefully from bullish call options to bearish puts since Powell's speech on Friday.

23. S&P flows. Flows into major S&P 500 ETFs have rolled over into negative territory.

24. S&P revenue growth. "If you net out energy, S&P 500 companies barely grew their revenues during the second quarter in real terms."

25. Volatility Index. "VIX term structure is shifting higher today, but we remain in contango, so there is no 'real panic' in VIX yet".

26. ARKK 0.00%↑ vs. Dotcom Nasdaq. And finally, this analogy is still holding up quite well.