Daily Chartbook #2

19 charts

Welcome back to PAV Chartbook: market charts, data, research, and insights pulled from various sources around the Internet by a solo retail investor.

1. CFO outlooks. CFOs are optimistic about their respective companies. Not so much when it comes to the overall economic outlook.

2. Are we already in a recession? According to the Atlanta Fed (and the “textbook” definition), we are already in a recession. GDPNow projection for real GDP growth (seasonally adjusted annual rate) is now -1.6%. That’s a tick lower than the -1.5% estimate from just 4 days ago.

3. What everyone else thinks. The median forecast for Q2 GDP growth is now down to 0.7% (seasonally adjusted annual rate).

5. Starts slowdown. Housing starts dropped to a 14-month low as homebuilder sentiment declines. Starts are down 14% YoY.

6. Mortgage rates. The negative sentiment is driven primarily by affordability (or a lack thereof). The average rate on a 30-year fixed-rate mortgage increased to 5.82% from 5.74%.

7. Median sales price of existing US home = $416,000. Even so, median US home prices reached another all-time high and are now up 41% over the last 2 years.

8. Inventory: a long way to go. A big reason for stubborn home prices is inventory, which is admittedly rising rapidly, but still historically low.

9. Home prices chill out? Home prices have enjoyed positive YoY growth for 124 consecutive months. They’re definitely still rising, but the pace at which they’re rising has slowed.

10. Demand is weak. Demand for home loans fell for the 3rd straight week as mortgage applications dropped 6.3%. Demand is now at its lowest level since April 2020.

11. 5-month streak. Existing home sales fell for the 5th straight month in June, this time by 5.4%. It marks the 10th straight month with sales down YoY. Interestingly, days-on-market is at record lows. My guess is a combination of low inventory and buyers wanting to finalize sales before mortgage rates increase further.

12. The meat of earnings season. Roughly 50% of the S&P 500 reports next week—buckle up!

13. Earnings growth and PMI. Expectations for Q2 EPS earnings growth (excluding energy) are very negative. More so than the global composite PMI is implying.

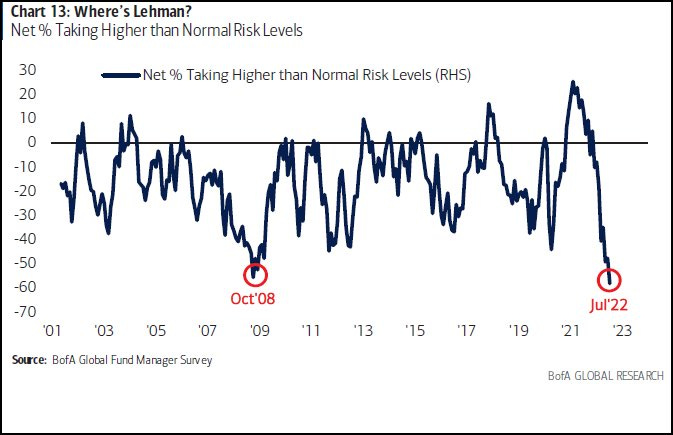

14. Recession likely? Fund managers are not very optimistic.

15. Lehman Bros-levels. The same managers are predictably walking on eggshells. Their positioning is more risk-off now than during the Great Financial Crisis.

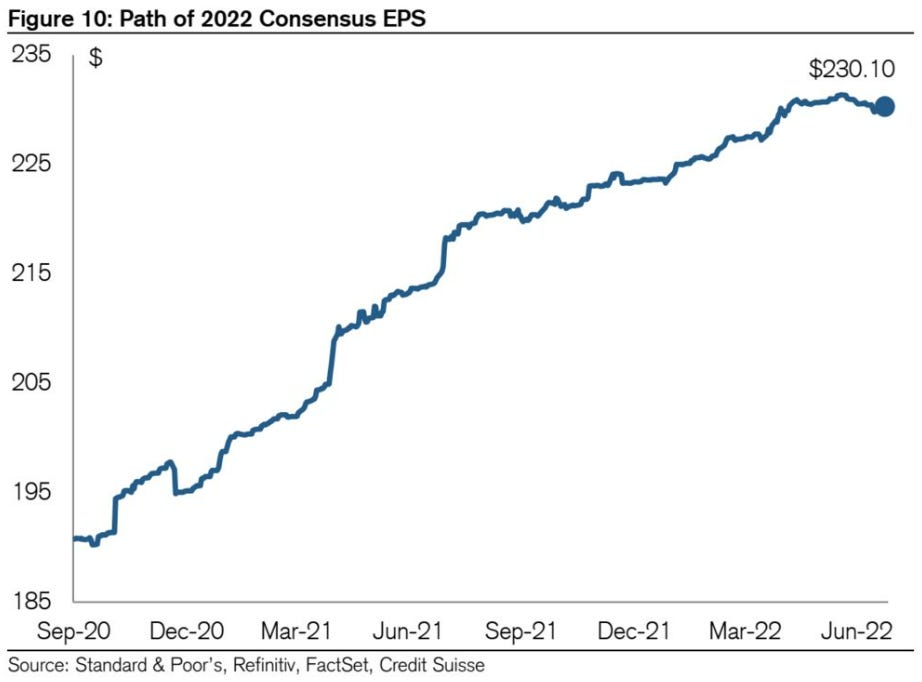

16. More pessimism. Will global profits improve next year? Fund managers have never been more certain that they will not.

17. But the consensus… This is interesting because consensus earnings estimates—despite all of the doomsday talk of negative revisions—are showing “total resilience”.

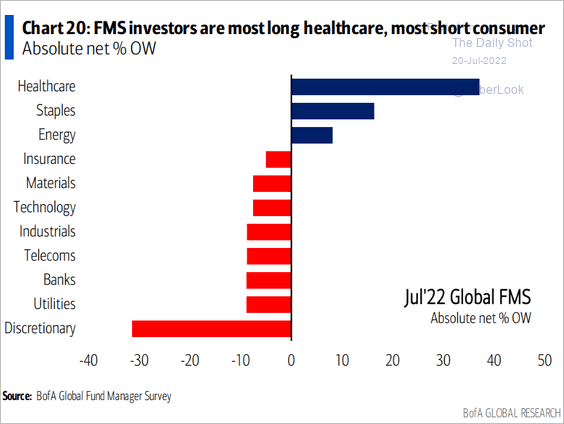

17. Positioning. Here’s how these same fund managers were positioned ahead of the current rally.

18. Value vs. Growth. Fund managers now have less conviction in value over growth stocks.

19. Short the world. The chart below shows global macro hedge fund beta to world equities. It means these funds are now the shortest they’ve been on equities in 36 months.